Comdirect Pioneering Digital Banking in Germany

Comdirect has long stood as a beacon of innovation in the German financial landscape, offering smart, user-friendly solutions that empower individuals to take control of their finances. Founded with a vision to make banking accessible and efficient, comdirect continues to thrive by blending cutting-edge technology with reliable services. Whether you’re saving for the future, investing in stocks, or simply managing daily transactions, comdirect provides tools that fit seamlessly into modern life. In this article, we’ll explore everything from its rich history to its forward-looking features, highlighting why comdirect remains a top choice for savvy Germans. After all, in an era where convenience is king, comdirect helps you stay ahead of the curve.

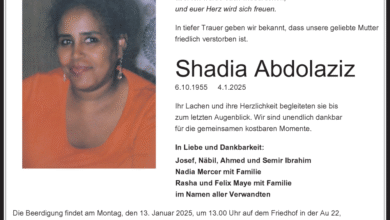

The official logo of comdirect, symbolizing simplicity and reliability in banking.

The Origins and Evolution of Comdirect

Let’s dive right into where it all began. Comdirect was established in 1994 by Commerzbank, marking one of the earliest forays into direct banking in Germany. At a time when online services were just emerging, comdirect aimed to bypass traditional brick-and-mortar branches, offering customers the freedom to handle their finances remotely. This bold move paid off, as it quickly grew into the third-largest direct bank in the country, headquartered in Quickborn, Schleswig-Holstein.

Over the years, comdirect has evolved dramatically. In 1999, Commerzbank supported its growth by enhancing digital infrastructure and even selling computers to help customers get online. By the early 2000s, it had become synonymous with online brokerage and advisory services. A pivotal moment came in 2020 when Commerzbank acquired the remaining shares, fully integrating comdirect as a subsidiary. This strengthened its position, allowing it to leverage the parent company’s resources while maintaining its agile, digital-first approach.

Fast forward to 2021, comdirect transformed into a digital advisory bank, combining expert advice with seamless online tools. This multi-channel model introduced nationwide advisory centers, bridging the gap between digital convenience and personal touch. Today, with total assets exceeding 29 billion euros as of 2019 figures (and likely grown since), comdirect exemplifies resilience and adaptation. Its journey from a startup-like venture to a cornerstone of German banking shows that embracing change can lead to lasting success. Indeed, comdirect’s story inspires optimism, proving that innovation keeps financial institutions relevant in a fast-paced world.

Ownership and Structure Within Commerzbank

Comdirect operates as a wholly owned subsidiary of Commerzbank AG, Germany’s second-largest retail bank. This relationship provides comdirect with stability and access to a vast network, while allowing it to focus on its niche in direct banking. Headquartered in Quickborn, comdirect benefits from Commerzbank’s extensive expertise, which includes over 20,000 employees dedicated to retail services in Germany alone.

The integration has been smooth, with comdirect retaining its brand identity even after the full acquisition. This setup ensures that customers enjoy the best of both worlds: the innovative spirit of a direct bank and the backing of a major financial powerhouse. For instance, comdirect’s SWIFT code, COBADEHDXXX, reflects its ties to Commerzbank, facilitating secure international transactions.

Looking ahead, as Commerzbank announces plans in 2025 to streamline operations for greater digitalization and sustainability—including job optimizations to boost efficiency—comdirect stands to gain from these initiatives. This optimistic outlook suggests comdirect will continue to flourish, driving forward with enhanced tools and customer-focused strategies. It’s a partnership that not only secures comdirect’s future but also enhances trust among users who value reliability.

Core Banking Services at Comdirect

At its heart, comdirect excels in providing everyday banking solutions that are straightforward and efficient. From checking accounts to savings plans, everything is designed with the user in mind. Their Girokonto, for example, offers free account management under certain conditions, making it ideal for daily transactions.

What sets comdirect apart is its emphasis on self-determination in finances—”Finanzen selbstbestimmt,” as their slogan goes. Customers can easily transfer money, pay bills, or set up standing orders via an intuitive online platform. Plus, with Visa cards included, shopping becomes hassle-free, both domestically and abroad.

For those building wealth, comdirect’s savings accounts boast competitive interest rates, encouraging long-term planning. They also offer home mortgages and closed-end funds, catering to diverse needs. Transitional phrases like “moreover” highlight how these services interconnect; for instance, linking a savings account to investments streamlines your portfolio management.

In a nutshell, comdirect’s banking services foster financial independence, turning what could be a chore into an empowering experience. With such robust offerings, it’s no wonder users feel optimistic about their financial journeys.

Investment and Trading Opportunities with Comdirect

If you’re keen on growing your wealth, comdirect shines brightly in the investment arena. As a leading online broker, it provides access to a wide array of securities, including stocks, bonds, ETFs, and funds. Trading is made simple through their platform, where you can execute buy and sell orders swiftly on German and international exchanges.

One standout feature is their depot accounts, which allow for diversified portfolios without hefty fees. Beginners appreciate the educational resources, like market analyses and tutorials, that demystify investing. For seasoned traders, real-time data and advanced charting tools keep you in the loop.

Comdirect also promotes sustainable investing, aligning with modern values. Imagine dipping your toes into green funds—it’s as easy as pie. With low transaction costs and transparent pricing, comdirect makes investing accessible, not intimidating.

Overall, these opportunities reflect comdirect’s commitment to helping customers thrive. By providing tools that adapt to market shifts, comdirect instills confidence, paving the way for prosperous futures.

A screenshot of the comdirect mobile app, showcasing user-friendly account overview.

The Comdirect Mobile App: Banking on the Go

In today’s mobile world, comdirect’s app is a game-changer, putting your finances at your fingertips. Available on iOS and Android, it offers a sleek interface for checking balances, transferring funds, or even trading stocks—all from your smartphone.

Features like biometric login add convenience without skimping on security. You can scan invoices for quick payments or monitor investments in real-time. It’s like having a personal banker in your pocket, ready whenever you are.

User reviews praise its reliability, noting how it simplifies complex tasks. Moreover, integrations with other apps enhance functionality, such as budgeting tools or notifications for market changes.

As digital banking evolves, comdirect’s app leads the charge, making life easier and more efficient. This innovation underscores why comdirect is poised for continued success, delighting users with every tap.

Security Measures and Customer Protection

Security is paramount at comdirect, where multiple layers protect your assets. From two-factor authentication to encrypted transactions, they’ve got you covered. Their robust system includes TAN procedures for added verification, ensuring only you access your accounts.

In case of issues, deposit protection up to 100,000 euros per customer via the German Deposit Guarantee Scheme provides peace of mind. Comdirect also educates users on phishing avoidance, fostering a proactive approach.

These measures build trust, showing comdirect’s dedication to safety. After all, in banking, security isn’t just a feature—it’s the foundation. With such safeguards, customers can focus on growth, optimistic about their protected futures.

Customer Support and Community Feedback

Comdirect prides itself on responsive support, available via phone, email, or chat. Their team of experts offers personalized advice, whether on loans or investments. Community forums and FAQs further empower users to find answers independently.

Feedback from platforms like Reddit highlights comdirect’s strengths in security and ease, though some note the multi-step processes as thorough rather than cumbersome. Positive reviews often mention quick resolutions and helpful guidance.

This customer-centric approach strengthens loyalty, making comdirect a trusted partner. By listening and adapting, they ensure satisfaction, fueling an optimistic view of banking relationships.

Innovations and Future Prospects for Comdirect

Looking forward, comdirect is at the forefront of fintech innovations. With Commerzbank’s 2025 digitalization push, expect enhanced AI-driven advice and sustainable options. Features like robo-advisors could personalize investments further.

As Germany embraces eco-friendly finance, comdirect’s green initiatives will likely expand. This forward-thinking mindset positions it well against competitors.

In essence, comdirect’s future brims with potential, promising even smarter solutions. It’s exciting to think how it’ll continue revolutionizing banking, keeping customers empowered and optimistic.

Comparing Comdirect’s Products

To help you decide, here’s a table outlining key products:

| Product Type | Features | Benefits | Fees |

|---|---|---|---|

| Girokonto (Checking Account) | Free transfers, Visa card, mobile payments | Everyday convenience, no monthly fees if active | Low or none for standard use |

| Savings Account | Competitive interest, flexible withdrawals | Builds wealth securely | Minimal maintenance fees |

| Depot (Investment Account) | Access to stocks, ETFs, funds | Diversified growth opportunities | Transaction-based, starting low |

| Loans and Mortgages | Personalized rates, quick approval | Funds for homes or projects | Interest varies by credit |

| Advisory Services | Expert consultations, digital tools | Tailored financial planning | Included in premium packages |

This comparison shows comdirect’s value, blending affordability with quality.

FAQs

What is comdirect, and how does it differ from traditional banks?

Comdirect is a direct bank subsidiary of Commerzbank, focusing on online services without physical branches. It differs by offering lower costs and digital convenience, ideal for tech-savvy users.

How do I open an account with comdirect?

Simply visit comdirect.de, fill out the online form, and verify your identity via video or PostIdent. It’s quick and straightforward.

Are my deposits safe with comdirect?

Yes, protected up to 100,000 euros per customer through the statutory deposit guarantee, plus voluntary schemes for extra coverage.

Can I trade internationally with comdirect?

Absolutely, comdirect provides access to global markets, with tools for real-time trading and analysis.

What are the app’s standout features?

The app includes account overviews, instant transfers, investment tracking, and secure login—making banking effortless on the go.

Fazit

In wrapping up, comdirect stands out as a dynamic force in German banking, blending tradition with innovation to offer unparalleled services. From its humble beginnings in 1994 to its current role in digital advisory, comdirect has consistently prioritized customer empowerment. With secure, user-friendly tools and a bright future amid digital advancements, it’s clear why so many choose it. Whether you’re just starting out or refining your portfolio, comdirect provides the foundation for financial success. Embrace the possibilities—after all, with comdirect, your financial future looks incredibly promising.